Last week’s blog highlighted five of the most impactful BEI webinars and sessions of 2023. This week, we’re bringing you our five most engaging and insightful podcasts of the year! In this series of BEI’s top 2023 podcasts, we showcase expert insights on Exit and Succession Planning, alongside cutting-edge tax strategies for family businesses.

Each episode offers valuable perspectives and practical advice, making them essential listening for professionals in the planning world. We invite you to explore these discussions to enhance your understanding and strategy in Exit Planning, and encourage you to connect with us for further growth in 2024!

Exiting on Your Terms: The Thoughtful Approach to Family Business Continuity Planning

In this episode, John Brown and expert guest Nick Niemann, an Exit and Succession planning attorney & Partner at McGrath North Mullin & Kratz, delve into the world of Exit Planning and the unique approach Nick takes to ensure the continuity and success of family-run businesses. Nick shared valuable insights on treating colleagues like family and the impact of a thought-out Exit Plan on everyone involved. This episode is a must-listen for anyone interested in Exit Planning, especially those in family-run businesses!

Listen now: Exiting on Your Terms: The Thoughtful Approach to Family Business Continuity Planning

Deferring Taxes with Section 453: A Key Element of Exit Planning

Dan Finn, founder of Finn Financial Group, and John Brown discussed how best to reduce the tax impact of selling a client’s business to a third party. John and Dan Finn explored the impacts of Section 453 and what you can do as an advisor to address the concerns of business owners when it’s time to sell their business.

Listen Now: Deferring Taxes with Section 453: A Key Element of Exit Planning

Presence is Paramount in Exit Planning

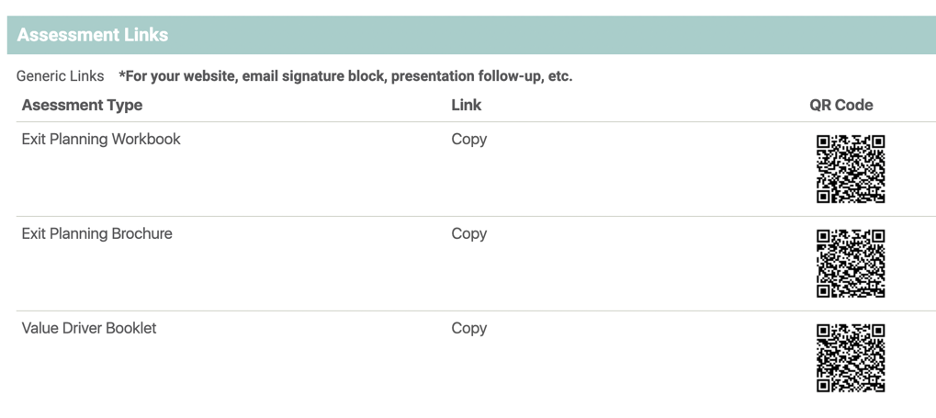

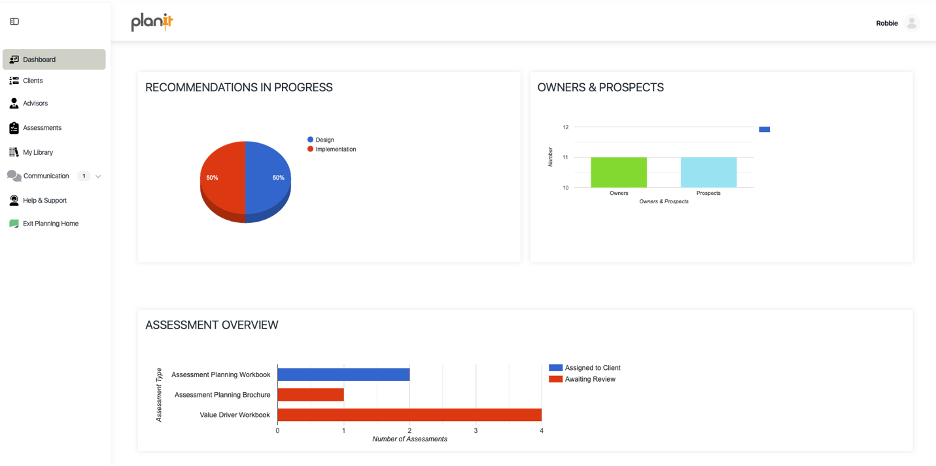

In this insightful episode, John Brown and Robert dePalo Jr., JD, CExP, Director of Business Planning with National Financial Network, opened with a candid conversation about attracting and engaging Exit Planning clients. Robert shared his experience in Exit Planning and how both planning processes and advisor tactics have evolved to meet the needs of the modern-day business owner.

Robert detailed which BEI tools have best served his practice and emphasizes the importance of staying relevant and present in the eyes of your clients and prospects. He shared one of his most effective social media strategies and how his partnership with BEI has improved his LinkedIn impressions, email open rates, and overall perception as a thought-leader in the Exit Planning space.

Listen now: Presence is Paramount in Exit Planning

Plan Your Exit: Expert Advice for Transitioning Out of Business Ownership

This thrilling episode featured estate planning lawyer, Alex Weatherly. John and Alex spoke about how he transitioned to being an Exit Planner, helping business owners transition their businesses to other family members or sell it. He discussed the importance of planning for business succession, as well as how estate planning is just one part of the overall planning process. Weatherly also shared some of his own experiences with poorly planned business successions and the importance of considering family relationships in the planning process.

Tune in here: Plan Your Exit: Expert Advice for Transitioning Out of Business Ownership

Maximizing Profits Through Tax Planning: Insider Plan Spreadsheet

In this podcast episode of “Why We Plan,” John Brown interviewed Keven Prather, a long-term member of BEI, who discussed a tool he uses to effectively communicate with his business owner clients. The BEI insider plan spreadsheet lays out the net after-tax effects of an insider transaction, allowing for scenario analysis and tax planning. They also discussed the concept of selling for the lowest defensible value and the importance of building a key employee team. Lastly, they briefly closed on the topic of Exit Planning and the idea of bringing up an internal team instead of selling.

Keven Prather is a registered representative of and offers securities and investment advisory services through MML Investors Service, LLC. TransitioNext Advisors® is not a subsidiary or affiliate of MML Investors Services, LLC, or its affiliated companies. OSJ: 2012 W. 25th St., Suite 900, Cleveland, Ohio 44113. 216-621-5680. CRN202603-4039457

Watch the Recording: Maximizing Profits through Tax Planning: Insider Plan Spreadsheet

The Bottom Line

BEI’s “Why We Plan” podcasts of 2023 speak to our diverse network of professionals that have shaped the industry year over year. From thought provoking discussions to applicable advice given by experts in the field, you can check out our entire catalog of podcasts and resources here!

We’d welcome the opportunity to speak with you more about these concepts and how you can use them to get more strategic meetings on the calendar with clients in 2024.